A View from the Tower

Tariffs 1.0: First Quarter 2025 Digestion

With trade and broader President Trump 2.0 policies, particularly on the tariff front, producing mixed messages, uncertain potential economic outcomes and growth fears, the S&P 500 had its worst quarter since the third quarter of 2022 and its worst month since December of 2022. Equities had a nice bump in January and generally were off slightly in February before selling accelerated in March. After initially viewing tariffs primarily as threats to help drive better trade deals, the narrative shifted toward the end of the quarter amid growing uncertainty surrounding “Liberation Day” on April 2. More to come on this topic later in this publication.

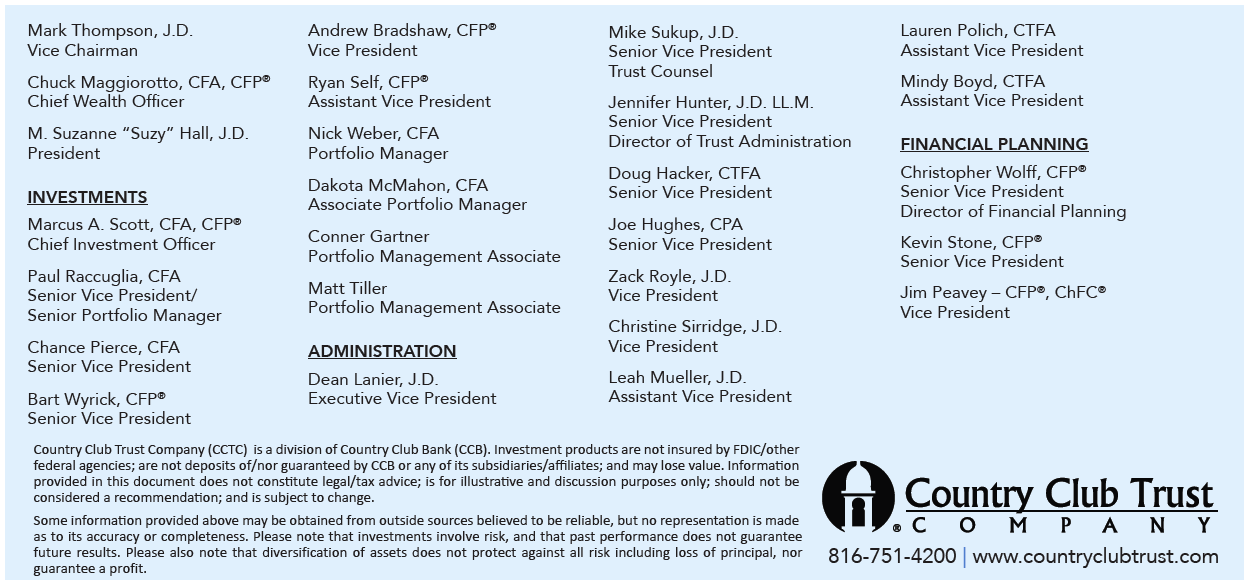

Notably, the highly publicized Magnificent Seven was a laggard as “value-style” equities turned the tables on their “growth” counterparts after an extended period of underperformance as the Russell 1000 Value Index gained over 2% while the Russell 1000 Growth Index sank by nearly 10%. Meanwhile, international stocks posted strong returns as the MSCI All Country World Index, excluding the United States, rose by over 7% as the dollar weakened and their lower valuation levels in general provided a tailwind. Arguments that the United States exceptionalism narrative was over were plentiful as well. Only time will tell.

Additionally in regard to Washington, actions by DOGE (The Department of Government Efficiency) caused some angst due to concerns around its austerity push, including how announced layoffs could impact what has continued to be a relatively stable labor market. The debate positioning the potential positives and negatives of the DOGE moves will likely continue.

On an encouraging note, the broad bond market rallied during the first quarter as yields sank across the yield curve. The Barclays Intermediate Government/Credit index posted a 2.4% total return.

Tariffs 2.0: Post First Quarter Announcements

Although announced post the end of the first quarter, it seems appropriate to comment on the President’s tariff decisions on April 2. Suffice it to say, with an estimated generation of approximately $500 billion in revenue, on top of the projected $150 billion from those previously enacted, the total is materially more than most anticipated. This represents over 2% of U.S. GDP and an overall tariff increase from 2% to over 20%; at least for now. On a country by country basis, percentages range from a base case of 10% (the United Kingdom for example) to a total of 54% in the case of China. Japan comes in at 24%; Taiwan at 32%; Vietnam at 46%; and the European Union at 20%.

Goods covered under the existing United States-Mexico-Canada Agreement (USMCA) will not be subject to these new tariffs, although non-compliant goods could. Additionally, previously announced tariffs on autos, steel, aluminum and energy will not.

In a world where dynamics tend to be more of a matrix than linear, what additional circumstances need to be considered?

- Will there be a legal challenge to these tariff increases? Chances of success?

- Will there be a flurry of activity accelerating purchases ahead of tariff implementation?

- Is there any possibility of tariff negotiations?

- Will Congress use this revenue to lower corporate and individual income tax rates?

- Will the negative market reaction motivate Congress to complete a tax bill sooner vs. later, as many perceive time to be of the essence? Memorial Day could be a key date in this regard.

- What impact will potential deregulation efforts have?

- Should we expect the U.S. budget deficit to come down, particularly in the short run?

- What are the foreign implications, including possible impacts for U.S. companies and products? Will there be retaliation, including non-monetary versions?

- Will this lead to a recession?

Certainly, quite a bit to contemplate and potentially digest, at some point.

As Usual, the U.S. Consumer Looms Large

As we have mentioned previously, consumers play a pivotal role in the U.S. economy as their spending accounts for approximately 70% of the Gross Domestic Product (GDP). When consumers are confident and consequently tend to spend more, businesses thrive, leading to job creation and economic growth. Conversely, when consumer spending declines, it can lead to economic slowdowns or even recessions. Related survey data during the first quarter seemed to reflect a somewhat cautious turn for not only consumers, but also businesses.

With doubts regarding the condition of the consumer in mind, the odds of a U.S. recession have trended higher since the end of 2024. While there is always a chance of recession in any one year (typically 15%) many economic prognosticators have increased their chances of recession to the 35% neighborhood (45% to 60% with Tariffs 2.0) as they have also cut back their U.S. Real GDP growth forecasts.

Unlike the approach during President Trump’s first term in office, where there was a flood of tax cuts and deregulation, followed by implementation of modest tariffs, the current plan looks to be the opposite with heavy tariffs, followed by tax cuts as the goal seems to be generation of revenue along with the revival of America’s industrial base and related workforce. A look at historical industrial production data reflects very slow growth over the last two decades or so as manufacturing has grown by just 4.3% over the last twenty-five years; 4.3% in total, not annualized. If this is indeed the path taken, near-term corporate earnings estimates would likely need to be revised downward; something to definitely keep an eye on as lower profits could presumably lead to layoffs, which in turn might slow consumption.

What Will the Federal Reserve Do?

Eyes remain on the Federal Reserve and what its moves will be in 2025. As most may recall, estimates by Fed followers, and by the Fed itself for 2024, at least at the beginning of the year, were materially off the mark. With the risk of being misguided again, The Fed is currently projecting two quarter point rate cuts during the remainder of 2025 (the market anticipates three or more), with the first possibly occurring in June. Additionally, Quantitative Tightening (QT) is set to slow significantly in April as the monthly decline in securities holdings (via bond sales) slides from $25 billion to $5 billion.

The Fed also is now looking for slower economic growth than previously estimated (1.7% vs. 2.1%) while raising its core Personal Consumption Expenditures (PCE) inflation forecast from 2.5% to 2.8%. With this at least on the radar, the term “Stagflation” has resurfaced.

All this being said, the Fed has remained relatively coy concerning guidance on what comes next as it digests ongoing data and remains “attentive to the risks to both sides of its dual mandate” of maximum employment and stable prices. At this point, economic growth may be more of an issue than inflation related risks, although tariffs could contribute to both.

What Now?!

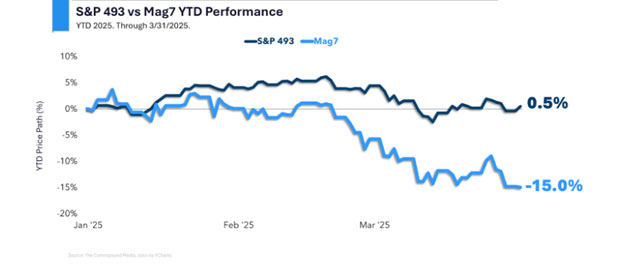

Although investment world crystal balls are never perfectly clear, the current environment seems like one of somewhat more cloudiness than typical, particularly in the short-term as there are numerous questions to be answered. This dynamic is present in the corporate world as well as many company leaders look to be in a wait and see mode before making significant commitments, which is understandable; and adds to the investment world opaqueness.

Although we have primarily focused on the “spinach” aspects of things to this point, there are some potential “candy” items to come. As mentioned, although the sequence of President Trump 2.0 vs. 1.0 has seemingly been reversed, there is an expectation that tax cuts and deregulation efforts will gain momentum and provide a tailwind to offset the anticipated impact(s) of various tariffs.

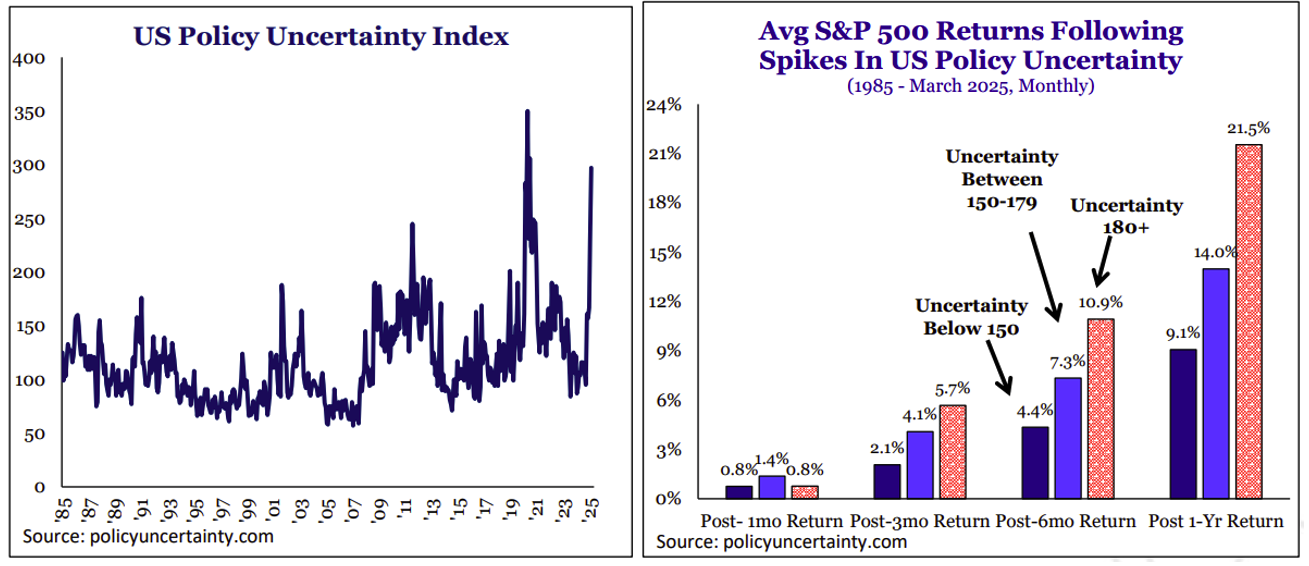

As all of us have been told many times, likely more than we have actually listened to and embodied, patience is a virtue. It’s not always easy admittedly, particularly in the current environment of divisiveness. However, as we have often stated, our portfolios are managed with both your risk tolerance and return objective in mind. We genuinely believe that time in the market is key, as attempting to time the market is a fool’s errand. In our view, compounding returns of high-quality portfolios is key towards achieving your financial goals.

Stocks represent the S&P 500 Shiller Composite for periods prior to 1936 and the S&P 500 thereafter. – JP Morgan Asset Management.

All of us at Country Club Trust Company, along with the entire Country Club Bank organization, hope that you and your families are well. Please be assured that we continue to work diligently on your behalf, providing the level of service you have come to expect and deserve. As always, we are ready and willing to be of assistance in any way we can. Should you have any questions, we are always here for you.

Take care.